48+ how much mortgage interest can i deduct in 2022

In addition to itemizing these conditions must be met for mortgage interest to be deductible. Learn More See If You Qualify.

Lawrence Journal World 12 14 12 By Lawrence Journal World Issuu

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

. Use NerdWallet Reviews To Research Lenders. So lets say that you paid 10000 in mortgage interest. Web For example if you got an 800000 mortgage to buy a house in 2017 and you paid 25000 in interest on that loan during 2022 you probably can deduct all.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Try Our Free Calculator To Receive a General Estimate If You Are Eligible. 12950 for tax year 2022.

Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard. Ad How Does A Reverse Mortgage Work. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Learn More See If You Qualify. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. The mortgage interest deduction.

Web Basic income information including amounts of your income. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Take Advantage And Lock In A Great Rate.

Use NerdWallet Reviews To Research Lenders. Web Keep your total interest amount in mind and compare it to the standard deduction for your taxpayer filing status. Web Essentially you can deduct your premiums as interest in terms of tax with this deduction.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Here are five homeowner tax breaks it pays to know about. Homeowners who are married but filing.

Discover Helpful Information And Resources On Taxes From AARP. Web For mortgages taken out since that date you can only deduct the interest on the first 750000 375000 if you are married filing separately. Ad How Does A Reverse Mortgage Work.

Web Most homeowners can deduct all of their mortgage interest. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. When you pay off your mortgage a portion of each monthly.

Single taxpayers and married taxpayers who file separate returns. And lets say you also paid. For example the standard deduction amounts.

Try Our Free Calculator To Receive a General Estimate If You Are Eligible. Take Advantage And Lock In A Great Rate. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Note that if you were. Web You cant deduct the principal the borrowed money youre paying back.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web If youve closed on a mortgage on or after Jan.

Web Standard deduction rates are as follows. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Mortgage Interest Deduction Tax Calculator Nerdwallet

![]()

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction Save When Filing Your Taxes

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Rules Limits For 2023

Disaster Covid 19 Business Lending Grants State Federal 21 501 Vermont Small Business Development Center

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

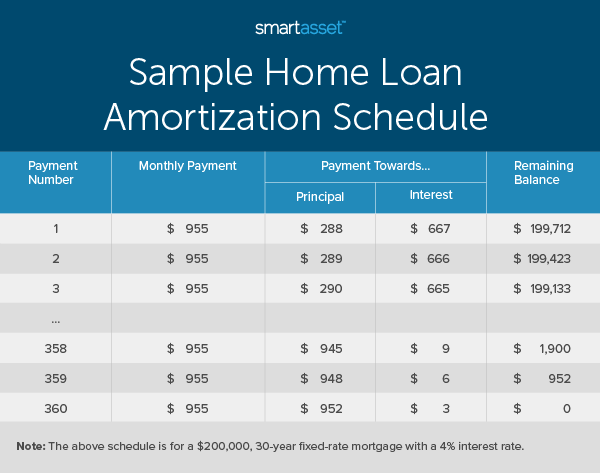

When Do Homeowners Pay More In Principal Than Interest 2021 Study Smartasset

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Tax Deduction Calculator Homesite Mortgage

Free 9 Sample Schedule C Forms In Pdf Ms Word

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

July 2009 By Upstate House Issuu

:max_bytes(150000):strip_icc()/TaxDeductibleInterest-10de394cbe27459ebb6f979a8f795083.jpeg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022